In the digital age, various forms of payment are readily available, but sometimes you need a secure and traceable alternative. That’s where money orders come in. Whether you’re sending money to a friend, paying rent, or making a purchase, a money order offers a reliable way to transfer funds without the need for a bank account. In this guide, we’ll walk you through everything you need to know about money orders, from what they are to how to obtain and use them.

What is a Money Order?

A money order is a paper document that serves as a prepaid alternative to a personal check. It’s issued by a bank, post office, or other financial institutions and is guaranteed by the issuer, making it a secure form of payment. Money orders are often used when the payer and payee are unfamiliar with each other, or when traditional forms of payment are not feasible.

Why People Use Money Order?

People use money orders for their security, convenience, and wide acceptance, especially in situations where other forms of payment may not be feasible or preferred. Here are some important reasons on why money order being used:

- Security: Money orders are considered a secure form of payment because they are prepaid and guaranteed by the issuer. Unlike personal checks, which can bounce if there are insufficient funds in the payer’s account, money orders are backed by the issuing institution.

- Anonymity: Money orders allow individuals to make payments without revealing sensitive banking information. Since they do not contain personal bank account details, they provide a level of anonymity for both the payer and payee.

- No Bank Account: Not everyone has a bank account, and for those individuals, money orders offer a convenient alternative for making payments or sending money. This is particularly useful for people who may not qualify for traditional banking services or prefer not to use them.

- Accepted Everywhere: Money orders are widely accepted, making them suitable for various transactions, including paying bills, rent, or making purchases. They can be cashed at banks, post offices, and other financial institutions, making them accessible to a broad range of people.

- Secure Transactions: Money orders provide a paper trail for financial transactions, which can be useful for record-keeping purposes. This can be beneficial for individuals and businesses alike, ensuring transparency and accountability in financial dealings.

- International Transactions: In some cases, money orders can be used for international transactions, providing a secure and traceable method for sending funds across borders.

How Much is a Money Order?

The cost of a money order varies depending on where you purchase it. Typically, fees range from a few cents to a few dollars. Some banks or financial institutions may offer money orders for free to their account holders. It’s essential to inquire about fees before purchasing a money order to avoid any surprises.

For an example, a money order from USPS will cost you an additional fee of:

- $1.75 for dollar amount of $0.01 to $500

- $2.4 for dollar amount of $500 to $1,000

Domestic money orders have a maximum limit of $1,000. Therefore, if you require an amount exceeding this limit, you will need to purchase multiple money orders. It’s crucial to fill out each money order accurately as they are one-time purchases, and maintaining thorough records of each transaction is essential.

Where to Get a Money Order?

You can purchase money orders from various locations, including:

- Banks: Most banks offer money order services to their customers.

- Post Offices: Postal services like USPS provide money order services.

- Retailers: Many grocery stores, convenience stores, and other retailers sell money orders.

- Check-Cashing Stores: Some check-cashing stores offer money orders for purchase.

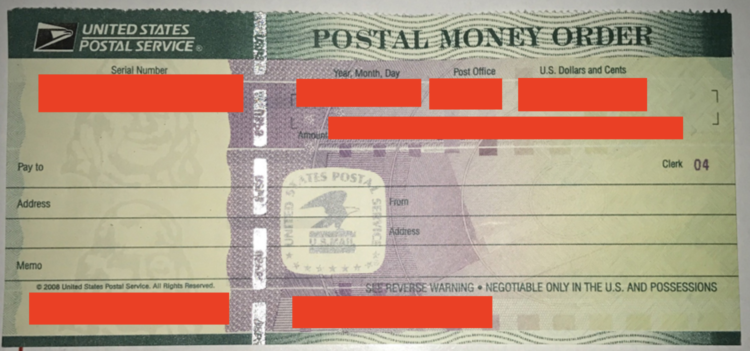

How to Fill Out a Money Order?

Filling out a money order is a straightforward process:

- Recipient: Write the name of the person or business you’re paying on the “Pay to the Order of” line.

- Your Information: Fill in your name and address in the “From,” “Purchaser,” or “Sender” field.

- Amount: Write the amount you’re paying in the designated space.

- Memo: Optionally, you can include a memo to indicate the purpose of the payment.

- Signature: Sign the front of the money order where indicated.

Typically, the money order issuer will input essential details, including the issuance time, issuer’s information, and the amount, both numerically and in written form.

How to Cash a Money Order?

To cash a money order, follow these steps:

- Endorse: Sign the back of the money order in the designated endorsement area.

- Verification: Ensure that the recipient’s name matches the name on your identification.

- Location: Visit a bank, post office, or other authorized location to cash the money order.

- Identification: Present a valid form of identification, such as a driver’s license or passport.

- Receive Payment: Once verified, you’ll receive the funds in cash or credited to your account.

Is there a Limit to Cash Out Money Order?

Yes, there is typically a limit to cashing out a money order in the USA, and it varies depending on the issuer’s policies. Most institutions, such as banks, post offices, and retail locations, will have their own limits on the maximum amount they will cash for a single money order.

These limits are often in place for security reasons and to prevent fraud. Additionally, financial institutions may have legal requirements to report large cash transactions to regulatory authorities as part of anti-money laundering efforts.

Example on How USPS regulation on cash out limit:

All U.S. money orders, including military, may be cashed at any U.S. post office or bank. Subject to funds availability, money orders may be cashed by rural carriers. Any customer whose daily total of cashed money orders exceeds $10,000, irrespective of the number of post offices visited to cash the money orders, must also complete Form 8105–A, Funds Transaction Report (FTR), and show identification bearing the customer’s photograph, name, and address.

DMM Revision: Elimination of the $10,000 Money Order Purchase Limit

It’s essential to check with the specific institution where you plan to cash the money order to determine their maximum limit.

If you have a money order above the cashing limit set by the institution, you may need to consider alternative options to access the funds. Here are some possible solutions:

- Deposit into Bank Account: Many banks allow customers to deposit money orders into their accounts, even if they exceed the cashing limit. You can deposit the money order through the bank’s mobile app, at an ATM, or by visiting a branch in person. Once deposited, the funds will typically be available according to the bank’s funds availability policy.

- Split the Amount: If the money order exceeds the cashing limit but is still within the institution’s maximum allowable amount, you can try splitting the amount into smaller denominations. For example, if the cashing limit is $1,000 and you have a $2,000 money order, you can cash $1,000 now and the remaining $1,000 later.

- Use Alternative Payment Methods: Consider alternative payment methods, such as cashier’s checks, wire transfers, or electronic payments, especially if you need to transfer a large amount of money. These methods may have different requirements and fees compared to money orders, so be sure to explore your options.

- Contact Issuer: In some cases, you may be able to contact the issuer of the money order and request assistance. They may offer solutions or guidance on how to proceed with cashing the money order above the limit.

- Third-Party Services: There are third-party services and check-cashing stores that may be willing to cash money orders above the limit, although they may charge higher fees for this service. Be sure to inquire about fees and requirements before proceeding.

How Can I Refund a Money Order?

If you need to refund a money order, you typically have to follow these steps:

- Receipt: Keep the receipt or stub from your original money order purchase.

- Issuer’s Policy: Contact the issuer (bank, post office, etc.) to inquire about their refund policy.

- Form: You may need to fill out a form provided by the issuer to request a refund.

- Processing Time: Refunds usually take several days to process, depending on the issuer’s procedures.

In conclusion, money orders provide a secure and reliable way to transfer funds, especially in situations where other forms of payment may not be suitable. By understanding how to obtain, fill out, cash, and refund money orders, you can confidently utilize this payment method for your financial transactions.