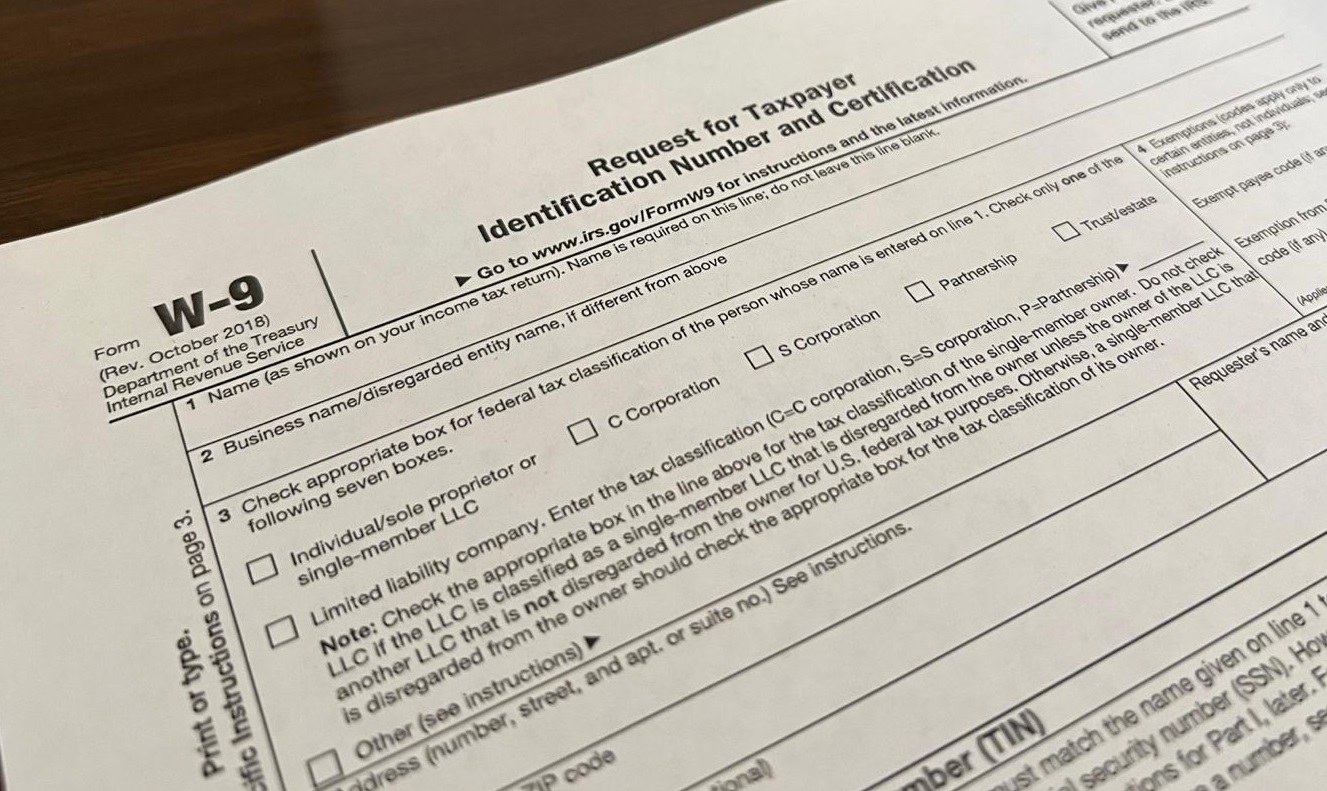

As the U.S. taxpayers and businesses find themselves navigating through various tax forms, and one that often raises questions is the W-9 form. Understanding when this form is required and its significance is crucial for individuals and entities engaged in financial transactions. In this blog post, we’ll delve into the ins and outs of the W-9 form, demystifying its purpose and shedding light on its importance.

What is Form W-9?

Form W-9, officially known as the “Request for Taxpayer Identification Number and Certification,” is an IRS document used in the United States for tax-related purposes. It is designed to collect essential information from individuals or entities that provide services as independent contractors, freelancers, vendors, or landlords. The purpose of Form W-9 is to gather the taxpayer’s identification number and certify that the information provided is accurate.

When is Form W-9 Required?

Form W-9 is typically required in various scenarios, including but not limited to:

1. Working as an Independent Contractor or Freelancer: If you are hired by a business or client as an independent contractor to provide services, the payer may ask you to complete Form W-9. The information collected on the form will be used to report the payments made to you to the IRS.

2. Receiving Rental Income: Landlords who receive rental income from tenants are also required to furnish a W-9 form. The information collected helps the payer report rental payments to the IRS.

3. Providing Professional Services: Businesses may request W-9 forms from vendors or service providers to whom they make payments for goods or services rendered. This is especially common when the payment exceeds $600 in a tax year.

4. Opening a Bank Account: Financial institutions may request a W-9 form from individuals or businesses when they open a new bank account. The bank uses this information for tax reporting purposes, especially for accounts that generate interest or investment income.

5. Tax Reporting and Withholding: Form W-9 is crucial for tax reporting and backup withholding purposes. If the IRS notifies the payer that the payee is subject to backup withholding, the payer must withhold a portion of the payment and remit it to the IRS. The W-9 form indicates whether backup withholding is required or not.

Properly Attain Your W9 Form

Form W-9 is a vital document that serves as the foundation for accurate tax reporting in various financial transactions. Whether you’re an independent contractor, freelancer, vendor, landlord, or opening a new bank account, knowing when and why the W-9 form is required is essential for smooth financial operations and compliance with IRS regulations.

As a responsible taxpayer or entity, it’s crucial to provide accurate and up-to-date information on Form W-9. Any discrepancies or inaccuracies may lead to tax reporting issues, delayed payments, or potential penalties. If you’re uncertain about when to fill out a W-9 form or have questions regarding the process, seeking advice from a tax professional can provide you with the clarity and guidance you need to navigate through tax-related matters with confidence.