Tax Saving Strategies. Are You Having It?

With advent of the internet and internet based jobs, millions of individuals are now self-employed. By relying on the internet jobs, people are now making more money by working either part-time or full-time on the internet. The thing that attracts the teenagers to the self-employment is the amount they get without stepping out from their home.

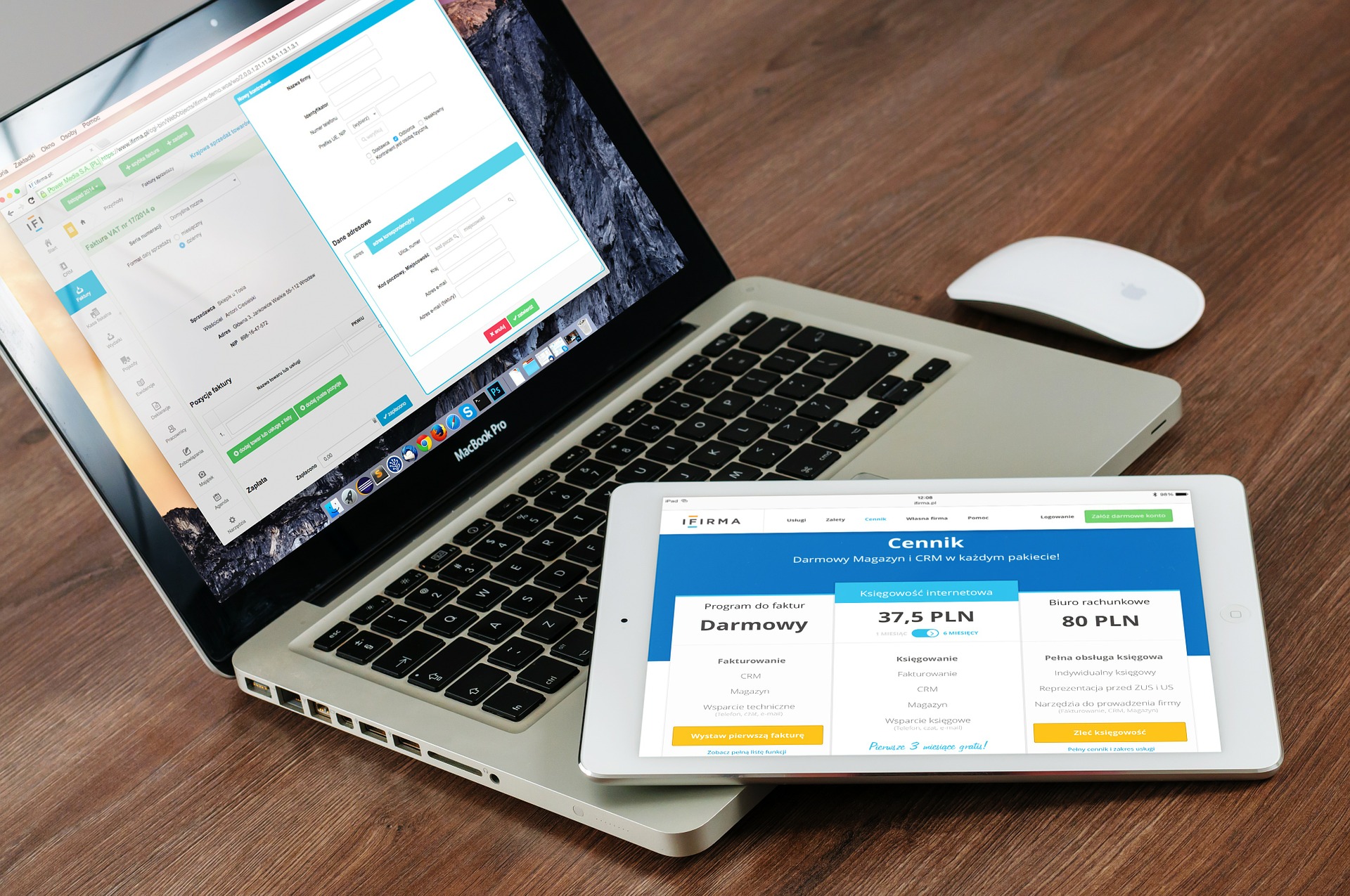

While working online, the thing that most of the self-employed persons neglect is the tax payment. In order to save the tax there are several strategies that can help them to have a look about the tax that they would be going to pay, and how they can minimize the tax by a considerable amount. Here are some tips that can help you to keep a good record of your earnings while working as a self-employed.

1. Keep records for daily earning

Keeping records is a good habit while working for self. This will help you to know about the money you are earning yearly, and you will be in a good platform to know whether you are a tax payer or not.

2. Separate your work and personal bank account

Another good way to know how much you are earning is to separate the personal and the work account. This will help you to know manage your personal and professional life, and will make your management more fluid and effective.

3. Keep the records of whatsoever you are spending to grow your business.

Keeping the records of your expenses for the business will not only help you to get the tax benefits, but it will also help you to know about the actual profit from the work. You can further refer to the HMRC helpline to get more specific details about the tax payment and relaxation strategies. They will guide through the procedure you need to follow, and help you to get the proper information to solve your queries.

By following these simple steps you can easily keep records of the amount that you will have to pay as a tax and do the necessary things to reduce the amount to its minimum.