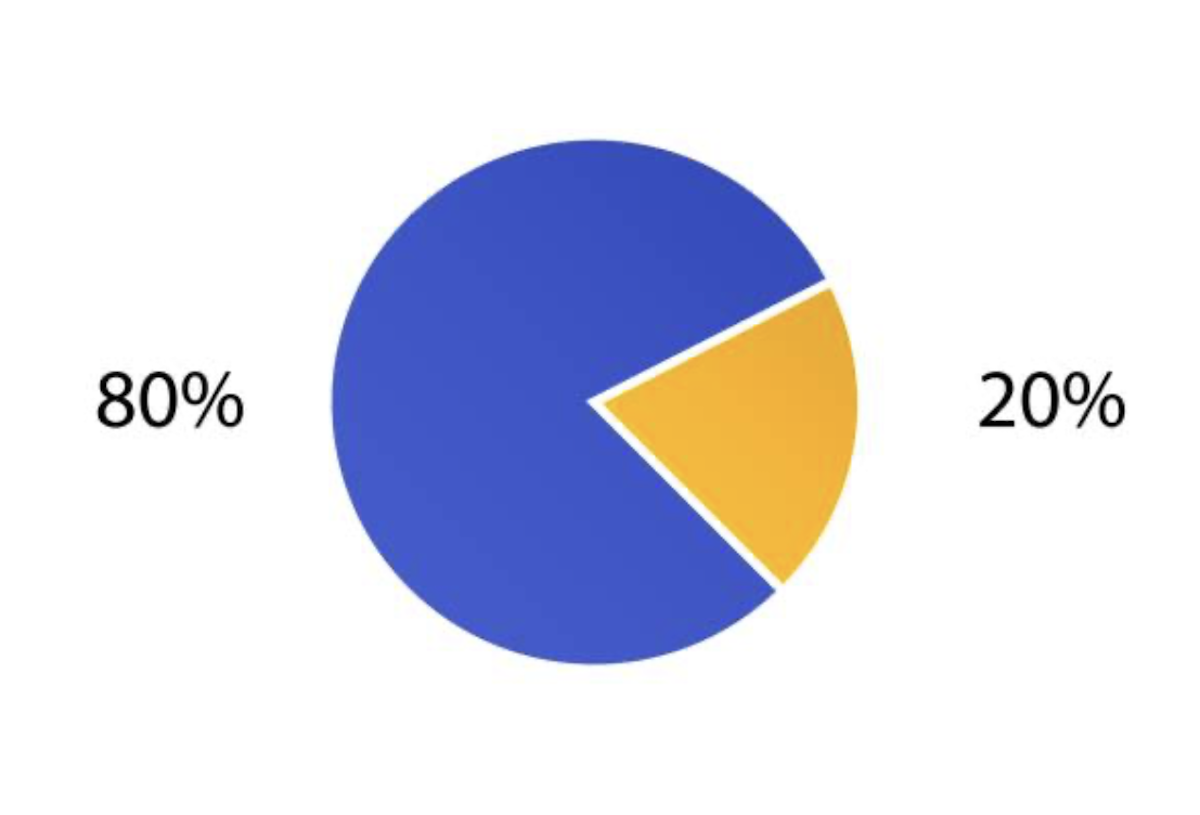

Personal finance is 20% head knowledge about money. This post will explain the other 80% about personal finance.

While personal finance knowledge is certainly an essential component of managing money effectively, there are various other factors that contribute to financial success. The remaining 80% can be attributed to the following aspects:

Financial Habits and Behaviors: Your habits and behaviors around money play a significant role in your financial well-being. This includes your spending patterns, saving habits, ability to budget effectively, and managing debt responsibly. Developing healthy financial habits and behaviors is crucial for long-term financial success.

Emotional Intelligence and Mindset: Your emotional intelligence and mindset have a substantial impact on your financial decisions. Being aware of your emotions, managing them effectively, and maintaining a positive mindset can help you avoid impulsive spending, make rational financial choices, and stay committed to your long-term goals.

Goal Setting and Planning: Setting clear financial goals and developing a solid financial plan is essential. This involves defining your objectives, creating a roadmap to achieve them, and regularly reviewing and adjusting your plan as needed. A well-thought-out financial plan provides direction and helps you stay focused on your objectives.

Risk Management: Understanding and managing financial risks is crucial. This includes having adequate insurance coverage to protect against unexpected events, diversifying investments to mitigate risk, and making informed decisions about financial products and services.

Income and Career Growth: The amount of income you earn and your career growth potential significantly impact your financial situation. Investing in your skills and education, pursuing career advancement opportunities, and maximizing your earning potential can contribute to long-term financial success.

Relationship and Communication Skills: Financial success can also be influenced by your ability to navigate financial conversations and collaborate with others. Effective communication and relationship-building skills are essential for managing joint finances, negotiating financial matters, and seeking professional advice when needed.

Adaptability and Financial Literacy: The financial landscape is constantly evolving, so staying informed and continuously learning about personal finance is crucial. Being financially literate and adaptable allows you to adapt to changes, make informed decisions, and take advantage of opportunities in the ever-changing financial world.

Remember that personal finance is a multifaceted subject, and no single factor can guarantee financial success. It is the combination of knowledge, habits, behaviors, mindset, planning, and various other factors that contribute to overall financial well-being. Strive for a holistic approach to your finances to maximize your chances of achieving long-term financial success.