As India positions itself to become a semiconductor powerhouse, it seeks to capitalize on its status as the world’s fifth-largest economy by enhancing self-reliance in manufacturing. With a bold target of expanding the electronics sector from $155 billion today to $500 billion by 2030, the nation’s ambitions have sparked both excitement and skepticism among industry experts.

Prime Minister Narendra Modi’s vision for the semiconductor industry is ambitious, yet many agree that achieving these goals will require substantial collaboration. While India is making strides, it is essential to recognize that the country is still in the early stages of developing its semiconductor ecosystem.

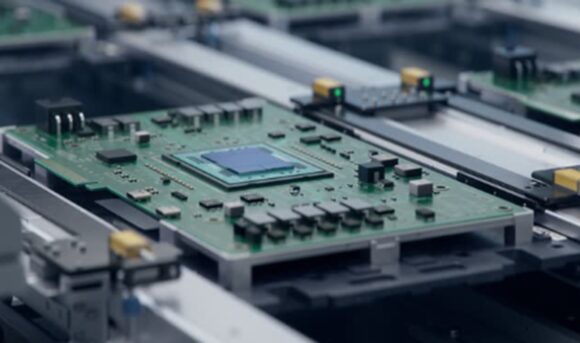

Currently, Taiwan dominates the global semiconductor market with a significant 44% share, followed by China, South Korea, the United States, and Japan. Experts emphasize that partnerships with established chipmakers are crucial for India to build a sustainable semiconductor industry. For instance, collaborations between Taiwan’s Powerchip Semiconductor Manufacturing Corporation and Tata Electronics are paving the way for India’s first 12-inch wafer fabrication plant in Gujarat. Similarly, American chipmaker Micron Technology plans to produce its first semiconductor chip in India by 2025, illustrating the vital role of international cooperation.

As companies seek alternatives to China amid ongoing geopolitical tensions, India is increasingly seen as a promising option. However, analysts caution that India must first develop its own capabilities before it can effectively compete with China’s established semiconductor sector. While India’s ambitions are commendable, it faces the challenge of rapidly advancing its technology and infrastructure to keep pace with its East Asian counterpart.

To bolster its semiconductor strategy, India is leaning on partnerships with the United States. The U.S. Department of State recently announced its collaboration with India’s semiconductor mission to enhance the global semiconductor supply chain. This partnership aims to reduce reliance on Taiwan and strengthen economic ties between the two democracies, particularly in the context of the ongoing “chip war” with China.

Modi’s recent engagements with tech giants, including Nvidia and Google, highlight the international interest in India’s semiconductor potential. These discussions indicate a willingness among leading companies to invest in India, which could further boost its position in the global semiconductor landscape.

Despite its challenges, India has distinct advantages that could propel its semiconductor industry forward. The nation boasts a competitive labor market, with significantly lower costs compared to China, making it an attractive destination for companies looking to diversify their supply chains. If India can harness its technological capabilities and provide quality products at competitive prices, it may gain a significant edge in the global market.

The ongoing investments in infrastructure, such as improved railways and airports, further position India as a viable player in the semiconductor space. With capital expenditure projected to rise, the country is poised to enhance its logistics capabilities, which are crucial for semiconductor manufacturing.

As the demand for chips continues to soar, India’s potential as a solution for global supply chain challenges becomes increasingly evident. The combination of a young workforce, a burgeoning domestic market, and strategic partnerships could ultimately pave the way for India to realize its semiconductor ambitions.

While India has a long road ahead, its commitment to collaboration and investment could transform it into a key player in the semiconductor industry, positioning the nation for a brighter economic future.