As tax season approaches, businesses and individuals alike find themselves navigating through a sea of tax forms and paperwork. One of the essential documents in the tax world is the Form W-9. If you want to download W9 form, we will dive deep into Form W-9, understanding its purpose, its significance, and, most importantly, how to download it correctly.

What is Form W-9?

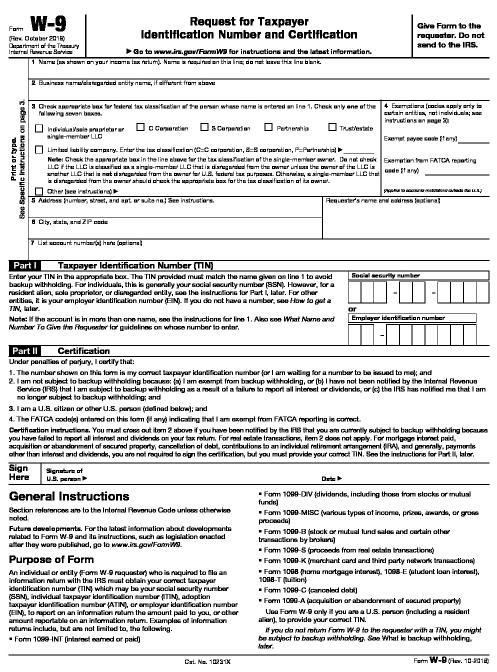

Form W-9, officially known as the “Request for Taxpayer Identification Number and Certification,” is a crucial IRS document used in the United States for tax-related purposes. The primary purpose of this form is to gather the necessary information from individuals or entities that provide services as independent contractors, freelancers, vendors, or landlords. It is used by the payers (businesses or clients) to report the payments made to these individuals or entities to the IRS.

When is Form W-9 Needed?

If you are an independent contractor, freelancer, vendor, or landlord who receives payments from businesses or clients, you may be required to fill out Form W-9. As a general rule, you should complete this form and provide it to the payer before you start providing your services or when you receive the first payment. This ensures that the payer has accurate information for tax reporting purposes.

Downloading Form W-9

Obtaining Form W-9 is a simple and straightforward process.

Download right away the W9 form below:

DOWNLOAD |

|---|

Filling out Form W-9

Form W-9 is relatively simple to complete. It requires basic information such as your name, business name (if applicable), address, and taxpayer identification number (TIN) or Social Security Number (SSN). The form will also ask you to certify that the provided information is accurate and that you are not subject to backup withholding.

Important Reminders

- Accuracy Matters: Ensure that you provide accurate and up-to-date information. Any discrepancies may lead to issues with your tax reporting or cause delays in receiving payments.

- Timely Submission: Always submit Form W-9 to the payer promptly. Delaying this process could result in delayed payments and reporting complications.

- Backup Withholding: If the IRS notifies you that you are subject to backup withholding, you must check the appropriate box on Form W-9. Backup withholding is when the payer withholds a portion of your payment and remits it to the IRS.

Download Your Form

Form W-9 is a fundamental document that facilitates tax reporting for individuals and businesses. Downloading and completing this form correctly ensures smooth financial transactions and compliance with IRS regulations. Whether you’re a freelancer, independent contractor, vendor, or landlord, understanding the significance of Form W-9 and its proper handling is vital for a hassle-free tax season.

Remember, it’s always a good idea to seek advice from a tax professional or accountant if you have any doubts or questions while filling out Form W-9. Being diligent with your tax obligations will save you time, stress, and potential penalties down the road. Happy tax season!