If you are a U.S. taxpayer and your spouse is a non-resident alien, you may need to complete IRS Form W-7, also known as the “Application for IRS Individual Taxpayer Identification Number” (ITIN), for your spouse. An ITIN is a unique identifier issued by the IRS for individuals who do not qualify for a Social Security Number (SSN) but need to fulfill tax-related obligations. In this blog post, we’ll provide you with a step-by-step guide on how to fill out Form W-7 for your non-resident alien spouse.

Step 1: Obtain Form W-7

To begin the process, you’ll need to obtain a copy of Form W-7. You can download the form HERE or request a physical copy by calling the IRS.

DOWNLOAD |

|---|

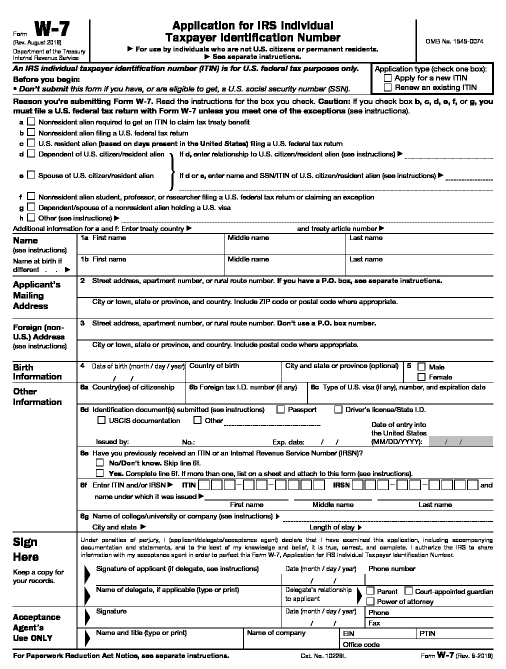

Step 2: Provide Identifying Information

Start by providing your identifying information on the top section of Form W-7. This includes your full legal name, mailing address, and, if applicable, your foreign address.

Step 3: Check the Appropriate Box

In Part I of the form, check the box labeled “a” for “Nonresident alien required to get ITIN to claim tax treaty benefit.” This indicates that the ITIN is being requested for your spouse to claim a tax treaty benefit.

Step 4: Spouse’s Information

Next, provide your spouse’s identifying information in Part II of Form W-7. This includes their full legal name, foreign tax identifying number (if any), date of birth, and foreign address.

Step 5: Reason for Applying

In Part III, you’ll need to provide the reason for applying for an ITIN for your spouse. Check box “h” to indicate that your spouse is a non-resident alien filing a U.S. federal tax return.

Step 6: Tax Treaty Article Number

If your spouse is eligible for a tax treaty benefit, you’ll need to enter the specific tax treaty article number in Part IV. Consult the relevant tax treaty to determine the appropriate article number.

Step 7: Supporting Documents

Form W-7 requires supporting documentation to verify your spouse’s identity and foreign status. Attach original and valid copies of these documents to the form. Acceptable documents may include a passport, national ID card, or visa issued by the U.S. Department of State.

Step 8: Complete the Form and Double-Check

Review the completed form to ensure all information is accurate and legible. Any errors or omissions could lead to processing delays or rejection.

Step 9: Mail the Application

Once the form is complete and all supporting documents are attached, mail the application to the address provided in the instructions for Form W-7. The address may vary based on your location.

Step 10: Await Processing

The processing time for Form W-7 applications can vary, but you can expect to receive your spouse’s ITIN in several weeks to months. Be patient while the IRS reviews your application.

Important Considerations:

- If you are a U.S. citizen or resident alien, you can file a joint tax return with your spouse using their ITIN.

- If your spouse is eligible for an SSN in the future (e.g., through employment authorization), they must use the SSN for tax purposes instead of the ITIN.

Fill W7 Form

Filling out Form W-7 for a non-resident alien spouse may seem daunting, but by following this step-by-step guide and providing accurate information and supporting documents, you can ensure a smooth process. Remember to check the latest instructions and requirements on the official IRS website and consult a tax professional if you have any specific questions or concerns. Obtaining an ITIN for your spouse will allow you both to fulfill your tax obligations and take advantage of any eligible tax treaty benefits.