As you start a new job or experience significant life changes, you may encounter IRS Form W-4, also known as the “Employee’s Withholding Certificate.” This form is essential as it determines the amount of federal income tax that your employer withholds from your paycheck. Filling out the W-4 correctly ensures that you have the right amount of taxes withheld, preventing surprises come tax season. In this blog post, we’ll provide you with a step-by-step guide to confidently fill out the W-4 form.

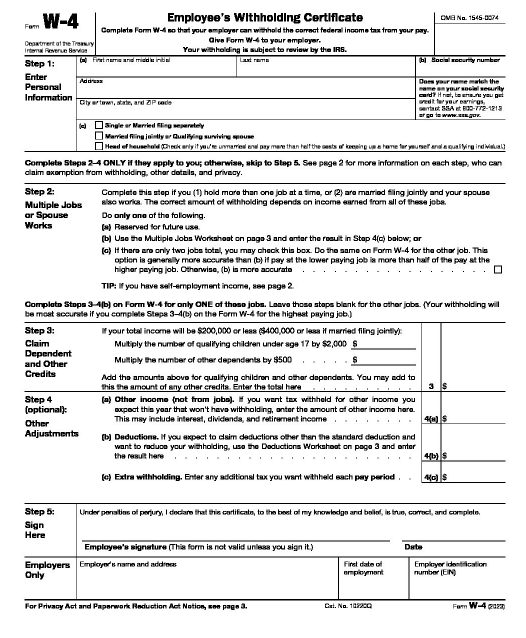

Step 1: Personal Information

Start by providing your personal information in the designated sections of the form. Include your full legal name, address, Social Security Number (SSN), and other requested details.

Step 2: Marital Status

Indicate your marital status by checking the appropriate box. You can choose from options like “Single,” “Married,” or “Married, but withhold at a higher Single rate” if applicable. If you are married but file separate tax returns, you should select the “Married, but withhold at the higher Single rate” option.

Step 3: Multiple Jobs or Spouse’s Income

If you have multiple jobs or your spouse also works, you may need to adjust your withholding. The IRS provides a “Two-Earners/Multiple Jobs Worksheet” on the W-4 form instructions to help you determine the additional amount to withhold.

Step 4: Dependents and Child Tax Credit

Claiming dependents can affect your tax withholding. If you have qualifying children or dependents, you can claim the Child Tax Credit, which may reduce your tax liability. Use the “Child Tax Credit and Credit for Other Dependents” section on the form to provide the relevant information.

Step 5: Other Adjustments

If you have other adjustments to your income or deductions, such as student loan interest or other tax credits, use the “Other Adjustments” section to include these details. This can help fine-tune your withholding based on your specific tax situation.

Step 6: Sign and Date

Double-check all the information you provided, and once you’re confident it’s accurate, sign and date the form. Remember, providing false information can lead to penalties and withholding discrepancies.

Step 7: Submit the Form to Your Employer

After completing the W-4 form, submit it to your employer’s HR or payroll department. They will use the information provided to determine the appropriate federal income tax withholding from your paycheck.

When to Review and Update Your W-4:

It’s essential to review your W-4 periodically, especially when significant life events occur, such as getting married, having a child, or experiencing a change in income. Changes in your personal or financial situation can impact your tax withholding.

DOWNLOAD |

|---|

Correctly Fill Out W4 Form

Filling out the W-4 form may seem intimidating at first, but with this step-by-step guide, you can approach it with confidence. Accurate information and proper withholding adjustments will ensure that you don’t encounter any surprises when tax season arrives. Remember to review and update your W-4 form when necessary and seek advice from a tax professional if you have specific questions or concerns. By mastering the W-4 form, you take control of your tax withholding and set yourself up for financial success.