Earning rewards on everyday purchases is one of the smartest financial moves you can make. But with hundreds of credit cards available, how do you choose the best rewards credit card for your needs?

This comprehensive guide breaks down the top rewards credit cards, comparing cash back, travel points, and premium perks—so you can pick the best card to maximize your spending.

Types of Rewards Credit Cards

Before diving into the best cards, let’s explore the three main types of rewards credit cards:

1. Cash Back Credit Cards

- Earn a percentage back on every purchase (e.g., 2% on all spending)

- Best for: Simple, flexible rewards

2. Travel Rewards Credit Cards

- Earn points or miles redeemable for flights, hotels, and more

- Best for: Frequent travelers

3. Premium Rewards Cards (Luxury Perks)

- High annual fees but offer elite travel benefits (airport lounge access, travel credits)

- Best for: Big spenders who value luxury perks

Best Rewards Credit Cards

🏆 Best Overall Rewards Card: Chase Sapphire Preferred®

✔ 60,000 bonus points ($750 in travel) after spending $4,000 in 3 months

✔ 2X points on travel & dining

✔ 1.25X redemption boost when booking through Chase Travel

✔ Annual fee: $95

💡 Best for: Travelers who want flexibility and high value.

🔗 Apply for Chase Sapphire Preferred®

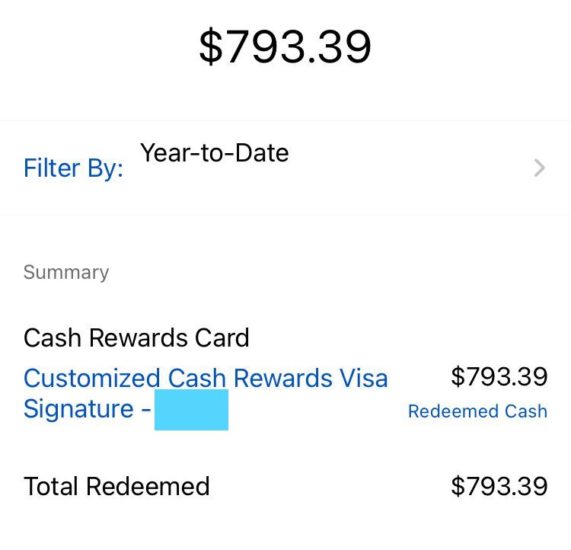

💰 Best Flat-Rate Cash Back Card: Citi® Double Cash Card

✔ 2% cash back on everything (1% when you buy + 1% when you pay)

✔ No annual fee

✔ Simple, unlimited rewards

💡 Best for: Those who want easy cash back with no category tracking.

✈ Best Travel Rewards Card: Capital One Venture Rewards

✔ 75,000 miles ($750 in travel) after $4,000 spend in 3 months

✔ 2X miles on every purchase

✔ No foreign transaction fees

✔ Annual fee: $95

💡 Best for: Frequent travelers who want simple, high-value miles.

🔗 Apply for Capital One Venture

🍽️ Best for Dining & Groceries: American Express® Gold Card

✔ 4X points at restaurants & U.S. supermarkets (up to $25,000/year)

✔ 3X points on flights booked directly with airlines

✔ $120 annual dining credit (Grubhub, Uber Eats)

✔ Annual fee: $250

💡 Best for: Foodies and big spenders on dining/groceries.

🛒 Best for Rotating Categories: Chase Freedom Flex℠

✔ 5% cash back in rotating quarterly categories (up to $1,500/quarter)

✔ 3% on dining & drugstores

✔ No annual fee

💡 Best for: Maximizing bonus categories each quarter.

🔗 Apply for Chase Freedom Flex

💎 Best Premium Travel Card: Chase Sapphire Reserve®

✔ 60,000 points ($900 in travel) after $4,000 spend in 3 months

✔ 3X points on travel & dining

✔ $300 annual travel credit

✔ Priority Pass lounge access

✔ Annual fee: $550

💡 Best for: Luxury travelers who want top-tier perks.

🔗 Apply for Chase Sapphire Reserve

How to Choose the Best Rewards Credit Card

1. Match the Card to Your Spending Habits

- Dining & groceries? → Amex Gold

- Travel often? → Chase Sapphire Preferred or Capital One Venture

- Want simple cash back? → Citi Double Cash

2. Consider the Annual Fee

- No-fee cards (Citi Double Cash, Freedom Flex) are great for beginners.

- Premium cards (Sapphire Reserve, Amex Platinum) offer perks that can offset fees.

3. Check Bonus Offers

Many cards offer $500+ in value just for meeting the sign-up bonus.

4. Look at Redemption Options

- Cash back: Most flexible

- Travel points: Higher value if transferred to airline/hotel partners

Pro Tips to Maximize Credit Card Rewards

✅ Use multiple cards (one for dining, one for travel, etc.)

✅ Pay your balance in full to avoid interest charges

✅ Track bonus categories (Freedom Flex, Discover It)

✅ Combine points (Chase Sapphire boosts point value)

Final Verdict: Best Rewards Card for You

| Best For | Recommended Card | Rewards Rate |

|---|---|---|

| Best All-Around | Chase Sapphire Preferred® | 2X on travel/dining |

| Best Cash Back | Citi® Double Cash | 2% on everything |

| Best Travel Card | Capital One Venture | 2X miles on all purchases |

| Best Dining Card | Amex Gold | 4X at restaurants/supermarkets |

| Best No-Fee Card | Chase Freedom Flex℠ | 5% rotating categories |

| Best Premium Card | Chase Sapphire Reserve® | 3X travel/dining + luxury perks |

Next Steps: Apply for the Best Rewards Card

- Check your credit score (most top cards require good to excellent credit)

- Compare bonuses & perks

- Apply for the card that fits your spending

🔗 Check Your Credit Score for Free: Credit Karma

Choose Your Best Credit Cards

The best rewards credit card depends on your spending habits and financial goals. Whether you want cash back, travel points, or luxury perks, there’s a card that maximizes your rewards.

By choosing strategically, you can earn hundreds (or thousands) in rewards every year—just by spending as you normally would!

📌 Bookmark this guide to reference the best rewards cards in this year! 🚀